Proposed Place of Business Provisions – A Roundtable with MOF/IRB

Proposed Place of Business Provisions – A Roundtable with MOF/IRB

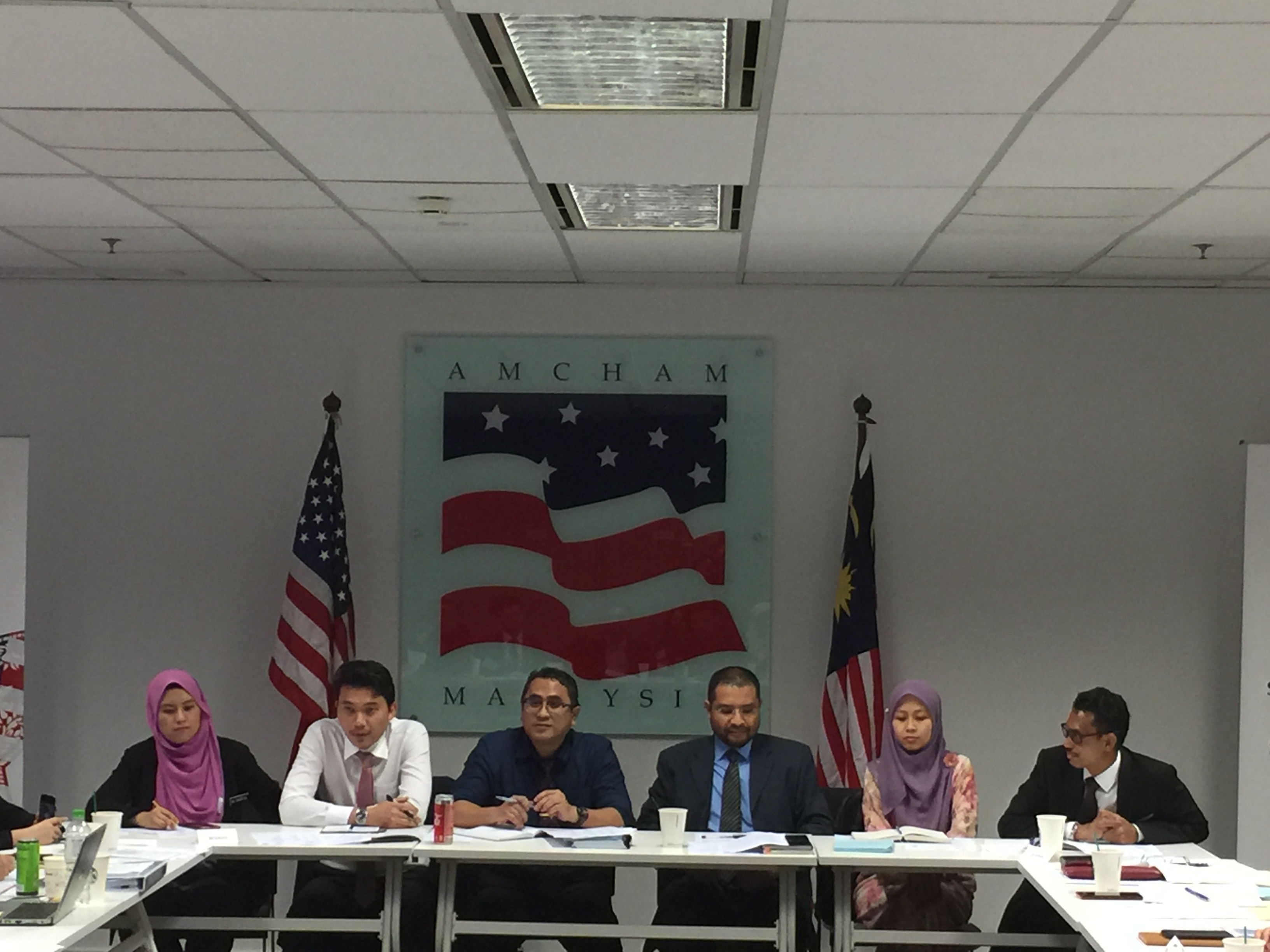

AMCHAM on Monday 29 April hosted an informal and closed-door dialogue between AMCHAM member companies and the Ministry of Finance (MOF), Inland Revenue Board (IRB), other government stakeholders regarding “Place of Business provisions” in the new subsections 12(3) and (4) of the Income Tax Act 1967.

Finance Directors and tax professionals from member companies welcomed the opportunity to take their questions directly to policymakers about the Place of Business provisions, and too seek clarity on how the provisions will be implemented and how this relates to the activities of American investors in Malaysia.

Interest in the dialogue was very high and attendance exceeded 50 people, of which approximately half were government officials and half were AMCHAM members.

This was our second public-private roundtable dialogue with MOF and the IRB – our last one took place in October and focused on Malaysia’s Participation in the Forum on Harmful Tax Practices (BEPS Action 5, OECD).

If you’d like to be included on the mailing list for future segments such engagements with policymakers in the investment and taxation space, please email [email protected]