[Workshop] Solving the Tax Technology Puzzle for e-Invoicing with EY

[Workshop] Solving the Tax Technology Puzzle for e-Invoicing with EY

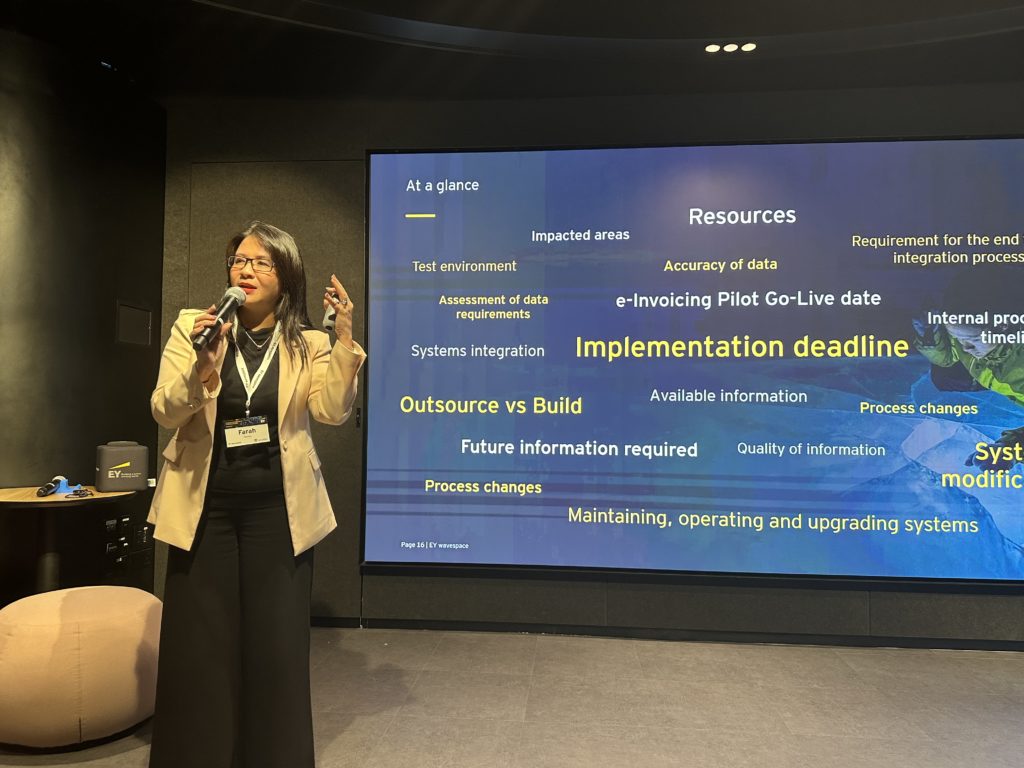

E-invoicing presents companies with a challenge because they need to integrate a nexus of functions, not just tax but finance, procurement, and more, to ensure successful deployment. The overall intent is to drive efficiency by leveraging technology to ease operations and reporting needs.

EY’s special session for AMCHAM members on “Solving the Tax Technology Puzzle for e-Invoicing” was attended by a host of member companies primarily from the finance and IT departments, others from technology or procurement. Tax and compliance staff, however, was always a filter and ever-present in the back of their minds.

Presenters, including a number of partners from EY, reviewed the technologies and requirements, pitfalls to avoid, and common technology issues that could arise. Successful examples and insights from other markets were also discussed in this session. Attendees then went into their breakout rooms for practical exercises and reconvened for a wrap-up during which each member shared a reflection encapsulated in an “I used to think…but now I realize…” statement pertaining to e-invoicing. Many expressed that they wished the session had gone on for longer but were glad they had come as they had learned much that they could take back to their offices.

Thank you to EY for organizing and conducting this workshop and helping us navigate the complexities of Malaysia’s move to e-invoicing on 01 August.